The Single Strategy To Use For Financial Education

Wiki Article

Financial Education Fundamentals Explained

Table of ContentsFacts About Financial Education RevealedFinancial Education Fundamentals ExplainedFinancial Education Things To Know Before You Get ThisHow Financial Education can Save You Time, Stress, and Money.Not known Facts About Financial EducationNot known Details About Financial Education Financial Education Can Be Fun For AnyoneOur Financial Education IdeasThe smart Trick of Financial Education That Nobody is Discussing

Without it, our economic choices and also the activities we takeor do not takelack a solid foundation for success.Together, the populations they serve span a wide variety of ages, incomes, and backgrounds. These teachers witness first-hand the impact that economic literacyor the absence of financial literacycan carry a person's life. We positioned the exact same question to each of them: "Why is financial literacy essential?" Right here's what they needed to claim.

Some Known Questions About Financial Education.

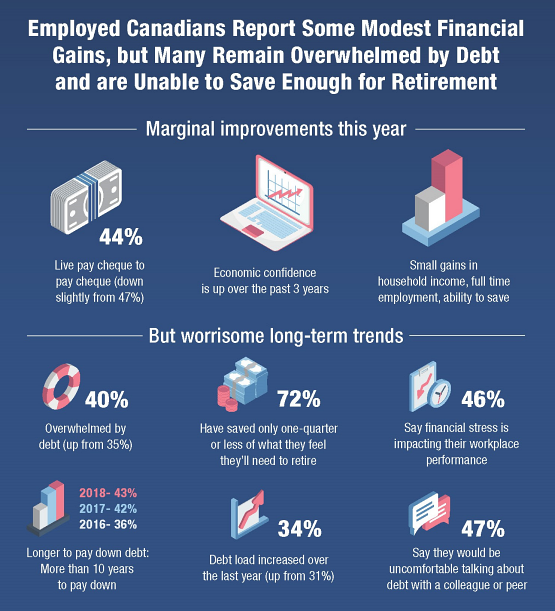

Our group is proud to be developing a new standard within greater education by bringing the topic of money out of the darkness. "Funds inherentlywhether or not it's unbelievably short-term in just acquiring lunch for that day or long-lasting saving for retirementhelp you achieve whatever your objectives are.Each year considering that the TIAA Institute-GFLEC survey began, the average percent of questions addressed correctly has increasedfrom 49% in 2017 to 52% in 2020. While there's even more work to be done to enlighten consumers concerning their funds, Americans are moving in the best direction.

The Single Strategy To Use For Financial Education

Do not allow the anxiety of jumping into the monetary world, or a feeling that you're "just not great with cash," avoid you from boosting your financial knowledge. There are small steps you can take, and also sources that can help you along the road. To start, benefit from free tools that may already be available to you.A number of banks and also Experian additionally offer cost-free credit report monitoring. You can use these tools to obtain an initial understanding of where your cash is going and also where you stand with your credit. Figure out whether the business you function for offers complimentary financial counseling or an employee monetary health care.

What Does Financial Education Do?

With a good or exceptional credit rating, you can get lower rates of interest on fundings and also bank card, credit scores cards with appealing and money-saving benefits, and a variety of deals for financial products, which provides you the opportunity to select the most effective offer. To enhance credit scores, you require to recognize what elements add to your rating. Best Nursing Paper Writing Service.This brand-new circumstance is resulting in higher uncertainty in the economic environment, in the financial markets as well as, certainly, in our own lives. Neither must we neglect that the crisis resulting from the pandemic has actually tested the of agents as well as households in the.

What Does Financial Education Do?

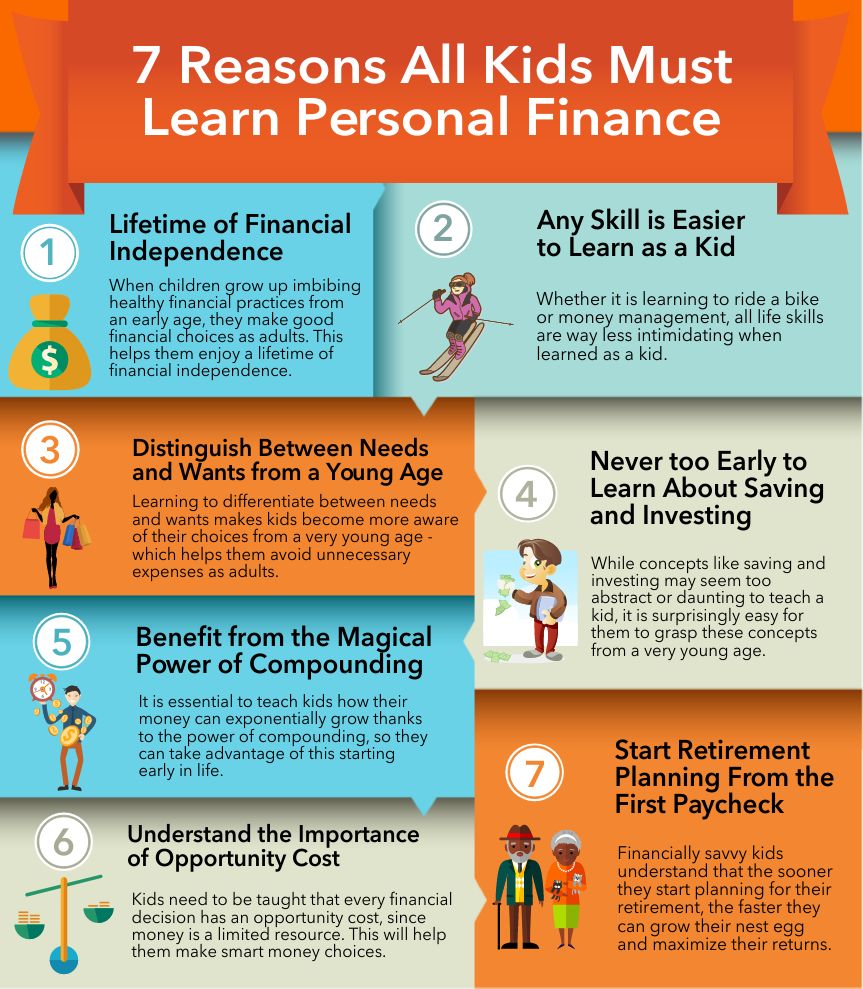

As we stated earlier, the pandemic has actually likewise raised using electronic networks by residents that have not always been electronically as well as monetarily equipped. Additionally, there are additionally sectors of the population that are less acquainted with technological breakthroughs as well as are therefore at. Including in this problem, in the wake of the pandemic you could try these out we have actually additionally seen the reduction of physical branches, specifically in backwoods.One of the greatest gifts that you, as a parent, can offer your children is the cash talk. As well as just like with that said other talk, tweens and also teenagers aren't always receptive to what moms and dads need to saywhether it's about authorization or substance interest. As teens come to be a lot more independent as well as assume about life after high institution, it's simply as vital for them to find out about economic proficiency as it is to do their very own washing.

Not known Facts About Financial Education

Knowing how to make audio money decisions currently will aid offer teenagers the confidence to make better decisions tomorrow. Financial literacy can be specified as "the capability to use knowledge and abilities to manage funds effectively for a life time of monetary health." In read this article brief: It's knowing how to conserve, grow, and also protect your cash.As well as like any type of skill, the earlier you discover, the more mastery you'll obtain. There's no much better location to talk regarding useful cash skills than in your home, so kids can ask questionsand make mistakesin a safe room. No one is extra interested in kids' economic futures than their parents.

The Buzz on Financial Education

By instructing children about money, you'll help them discover how to balance wants and needs without entering into financial debt. Older teenagers may desire to go on a trip with close friends, but with also a little monetary literacy, they'll comprehend that this is a "desire" they might require to budget and conserve for.

The Financial Education PDFs

, rather of offering an automated "no," assist them recognize that it's not free money.

The 10-Second Trick For Financial Education

Report this wiki page